Indexation benefit on sale of property removed; new LTCG rate of 12.5% announced for capital gains on sale of property

The budget 2024 announced the removal of indexation benefit available on sale of property. Due to this many people who sell their property will now not be able to inflate their purchase price and reduce their capital gains. Prior to the announcement the long term capital gains arising from sale of property was taxed at 20% within indexation benefit. Now as per the Budget documents, the new LTCG tax rate of 12.5% without indexation benefit will be applicable for capital gains on sale of property.

Here is an example to understand this, for instance MR. A bought a property with Rs 25 lakh in FY 2002- 2003. He sells the property in FY 2023-2024 for Rs 1 crore. As per the existing rules, the purchase price of Rs 25 lakhs needs to be inflated with CII numbers notified by the Income tax department. However, once the new rule comes into effect there will be no need to inflate the purchase price. A taxpayer will calculate the capital gains by directly reducing the purchase price from the sale price.

According to the FM budget speech 2024, "simultaneously with rationalisation of rate to 12.5%, indexation available under second proviso to section 48 is proposed to be removed for calculation of any long-term capital gains which is presently available for property, gold and other unlisted assets. This will ease computation of capital gains for the taxpayer and the tax administration.

What is Cost Inflation Index?

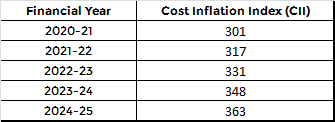

Every fiscal year, the income tax department publishes a Cost Inflation Index (CII) to be used in calculating indexation benefits. This figure is used to compute the inflation-adjusted cost of a long-term capital asset. To determine the taxable capital gain, the inflation-adjusted acquisition cost is removed from the asset's sale price. However, indexation benefits are only available for specific assets.

For the current financial year 2024-25 (AY 2025-26), the Central Board of Direct Taxes (CBDT) has notified the CII as 363. The notification was issued on May 24, 2024. The CII number for FY 2023-24 (AY 2024-25) was 348.

The inflation-adjusted purchase price of certain assets sold between April 1, 2023, and March 31, 2024, will therefore be determined by using CII 348 when filing income tax returns. The following year, CII 363 will be used to determine the inflation-adjusted purchase price of assets sold in current FY 2024-25 (AY 2025-26) - between April 1, 2024, and March 31, 2025.